- Details

- Hits: 1051

MGM in Maryland reached $705 million in 2018, and Aqueduct slots $697 million for the 12 months ending March 31, 2019. Wynn and Encore Las Vegas had total revenues in 2018 of $1.7 billion, but on the Strip, casino win was only 34% of total property revenue - although I am certain that Wynn's two properties had a higher percentage because of the level of premium player. The most likely leader in US commercial casino win in 2018 was the Borgata in Atlantic City, at $771 million.

Encore in Boston has invested $2.7 billion in facilities, primarily in restaurants, meeting space, entertainment and retail outlets, rather than on hotel rooms, and as the only gaming facility in the Boston area with a metropolitan population of 4.7 million, should exceed $800 million, by 2020.

Other eastern cities have more population, with Baltimore/Washington at 6.2 million, winning $1.74 billion at its Maryland casinos, and Philadelphia with 6.1 million persons and a 2018 win of $1.3 billion, from three full casinos, and one restricted facility.

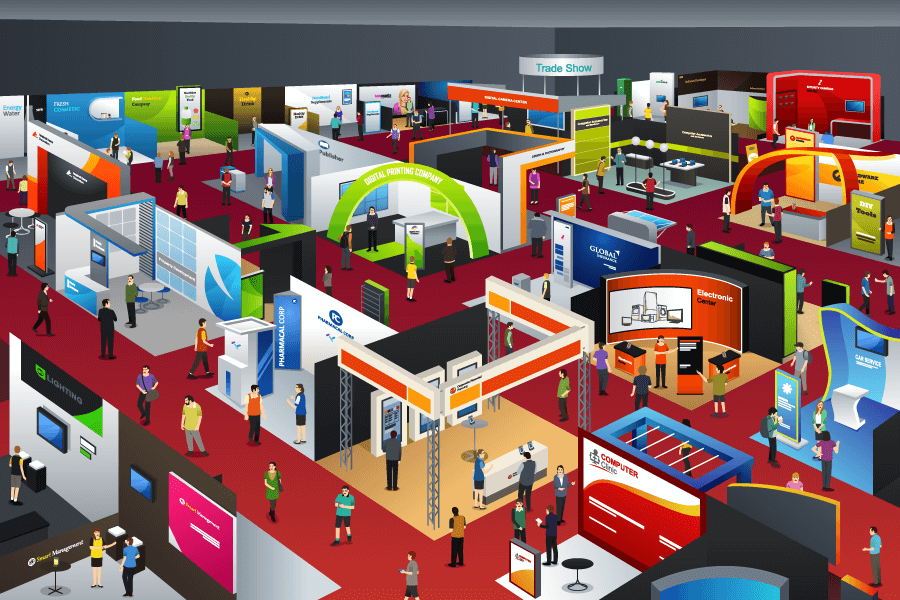

But Philadelphia and Maryland casinos have gaming tax rates nearly double that of Massachusetts’ casinos, restricting what they can spend promoting premium or even entry-level players. Plus, Encore can handle more customers in its casino and public areas than any property in PA or MD. There is little doubt, that the addition of a major casino will help the area to attract more conventions and trade shows to Boston while increasing the number of exhibitors and attendees at already planned events. Plus, with a major international airport nearby, expect to see additional growth in European visitors, as well as increases in US and Canadian visitation.

The convenience factor will be diminished by having a single casino to serve the entire Boston market, but the significance of the Encore property will draw from greater distances, and the typical Wynn/Encore customer more affluent, and the property will most likely take advantage of the favorable tax rate, and promote more high-level customers than its competitors in NY, MD and PA.

The state is expecting $300 million in Encore tax income, but that should include property and income taxes as well as hotel, food and beverage taxes, and possibly even estimated employee state taxes.