- Details

- Hits: 1180

Europe and the United Kingdom see most of their play and taxes from online sites and betting parlors, with very few real casino resorts, like Monte Carlo. But in the UK, recent interviews indicated that 30% of minors had gambled illegally last year at online sites or even at betting parlors - obviously absent of any meaningful oversight. And, to reduce the compulsive gambling problem in the UK, they recently reduced the maximum bet on their FOBT (Fixed Odds Betting Terminals) from 100 pounds to just 2 pounds and greatly expanded their restrictions on advertising.

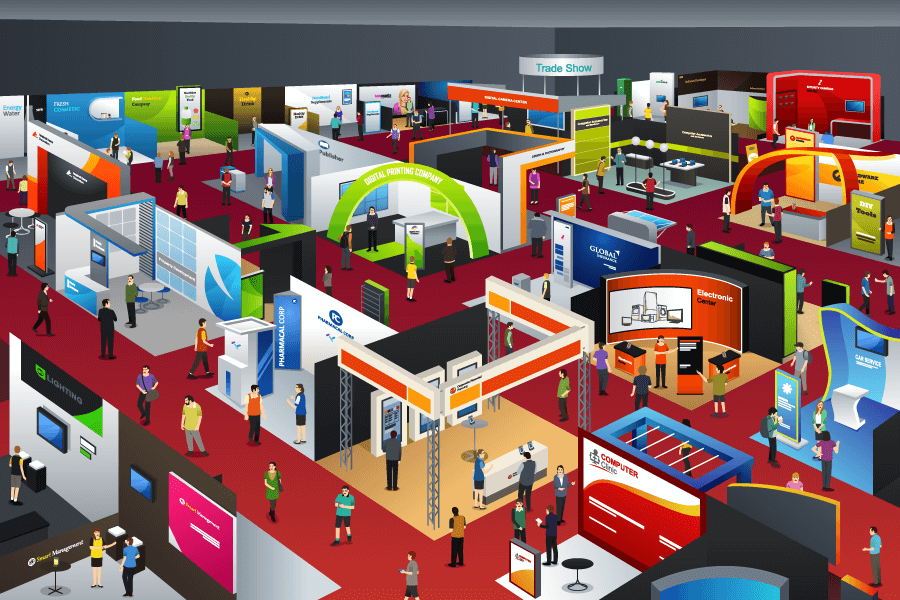

US gaming establishments, last year, employed 1.8 million persons, paid over $41 billion in federal, state and local taxes, and had an economic impact of $261 billion, according to the American Gaming Association. Gaming companies have invested hundreds of billions of dollars in constructing Americas’ gaming facilities. And other benefits for communities with casino gaming include a serious increase in hotel occupancies and average room rates as the presence of gaming increases the number of tourists and of convention/trade shows booked and expands the number of exhibitors and attendees. Additionally, local restaurants, retail, night clubs, museums, sports stadiums, and arenas, along with most other forms of commerce, benefit from the millions of new visitors.

The spread of online gaming has the capacity to have a very detrimental impact on live visits to established gaming properties and could replace ticket purchases at our 47 state lotteries. The convenience of online betting and online sports betting could see much more bet on sporting events, where there are several hundred in-game and proposition bets available on many games.

In the first 9 months of New Jersey's experiment with online sports betting, the state’s residents have bet $2.5 billion, but the win was only $125.5 million, 4.9% of amounts bet, and the state collected only $14.4 million in taxes, 0.6% of bets made. Atlantic City, hoping sports betting would drive new visitation to its 9 casinos, has only experienced 12.3% of the betting at its casinos. The other 87.7% at two North Jersey racetracks were on online sites where several AC casinos, especially Resorts International, winning $42 million with $41million of that on its Fan Duel online site.

The NJ lottery keeps, on average, 40% of all bets made on their various lottery games. So, what happens to NJ lottery programs, if residents bet more of their gaming dollars online, or the hundreds of bets available on most sports contests? At an effective tax of less than 1% on sports bets made, will the lottery lose any of its audience and the 40% the state keeps on the multiple lottery programs available? Obviously, sports betting will not offer Mega-Million games that offer prizes of hundreds or billions of dollars, but there are many fancy bets available on parlays or long shot results, that can act like many of the typical lottery prizes.

But as a gaming industry dinosaur, who has helped develop destination casino resorts on Paradise Island and Atlantic City, helped establish riverboat gaming in 4 states, and worked (as Sands President/COO) to convince Las Vegas Strip casinos to transcend from a preference of in-house conventions to city wide trade shows, I am concerned about the impact that the convenience of online gaming and sports betting will have on live visits to our many gaming facilities, as well as on our state lotteries that support important programs, such as education.

More online betting inevitably means more employee layoffs and an increase in bankruptcies where online taxes on gaming and sports betting may not equal the taxes lost on lotteries or from live visits to casino resorts where hotel accommodations, restaurant and beverage sales, showroom revenues, and live casino games, will all provide less in tax revenue.

This move to online gaming is obviously for state governments to find new voluntary taxes that residents graciously provide. But before jumping on the tax bandwagon, interested states should first study the potential negative impact on gaming employment and current levels of gaming taxes, plus the growth in compulsive gambling and minors betting illegally.

I would suggest carefully studying the potential impact on your own state lotteries, because you may be trading a 25% to 40% effective tax on various lottery bets, for 0.5% on online sports bets made. These low hold percentages are required if legal online sports betting is going to effectively compete with illegal overseas sites. Hopefully, states will also establish small fines for bettors using these illegal sites, and create much stronger penalties for the operators.