Search Site

NORTON NOTES: Taking a Look at Sports Betting Figures

- Details

- Hits: 838

By Steve Norton

CEO, Norton Management

There are many US states that are looking at various ways to introduce sports betting to their citizens, and many are considering online gaming bills that might also offer hundreds of in-game and proposition bets available on a single sporting event.

Nevada's experience with sports betting, shows that only about 2% of gaming revenues are from sports wagers and on each $100 bet, the federal government gets 50 cents, the casino earns about $5, and the state 34 cents, leaving the casino just over $4 to cover payroll, marketing, other variable costs, and hopefully end with a profit. But in reality, I think you will find that most Nevada operators like sports betting, because it brings customers into the property where sales and taxes are realized from restaurants, night clubs, accommodations, entertainment, meetings, and yes, even the slots and table games.

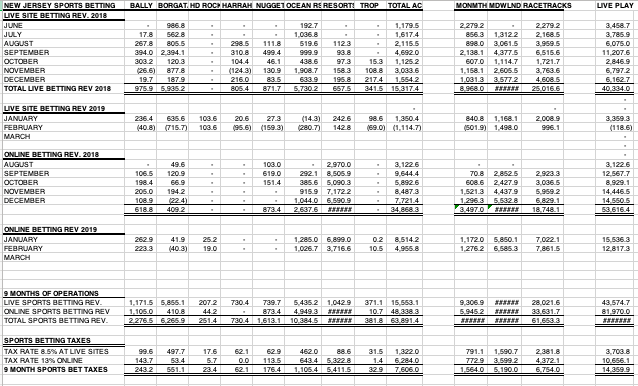

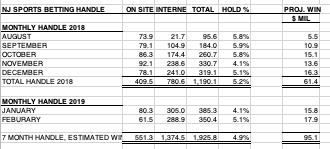

At the end of this article is a spreadsheet detailing the early results from New Jersey's addition of sports betting which is available at 8 Atlantic City casino resorts, 2 racetracks, and online. New Jersey fought hard for a number of years to kill the Wire Act but most in the gaming industry thought this was to help Atlantic City, that had lost around $3 billion in casino revenues since 2006.

Over the 9 months that AC has been operating sports books, the casinos have won $15.5 million, but only 12.3% of the $125.5 million that has been bet online and at 2 NJ racetracks. My old haunt, Resorts International has done a wonderful job with their online operations, generating $41 million on their internet site, but only $1 million at the property in Atlantic City.

States need to look beyond the new voluntary tax and look at the other impacts that could be very negative to their state lotteries, existing gaming and especially to individuals with compulsive tendencies considering the enormous convenience of sports betting opportunities, by phone or computer.

In 9 months, New Jersey has seen over $2.5 billion bet of sporting events, but with a win percentage of 4.9%, the sports betting revenue was only $125.5 million, and New Jersey earned just $14.4 million in new tax revenue, or less that 0.6% on every sports bet made. Compare that to the 40% that NJ’s lottery keeps from each dollar wagered on their many games.

But how many tax dollars were lost if more of that $2.5 billion was bet in Atlantic City - earning taxes from room, food and beverage sales, possible casino play, plus tolls on the NJ Turnpike and AC Expressway?

Plus, there are a lot of jobs at stake in Atlantic City, with Showboat soon joining Ocean Resort and Hard Rock, adding new capacity to the city with no new markets to draw from, unless we get new commercial air service from southern cities like Atlanta, where there currently is no gaming.